Term Life

Term life insurance is the most basic. It is purely an insurance policy and has no investment features. This is best for income support (making sure your family has income in case something happens to you). These policies cover the policyholder only for a specific, pre-defined time period or “term.”

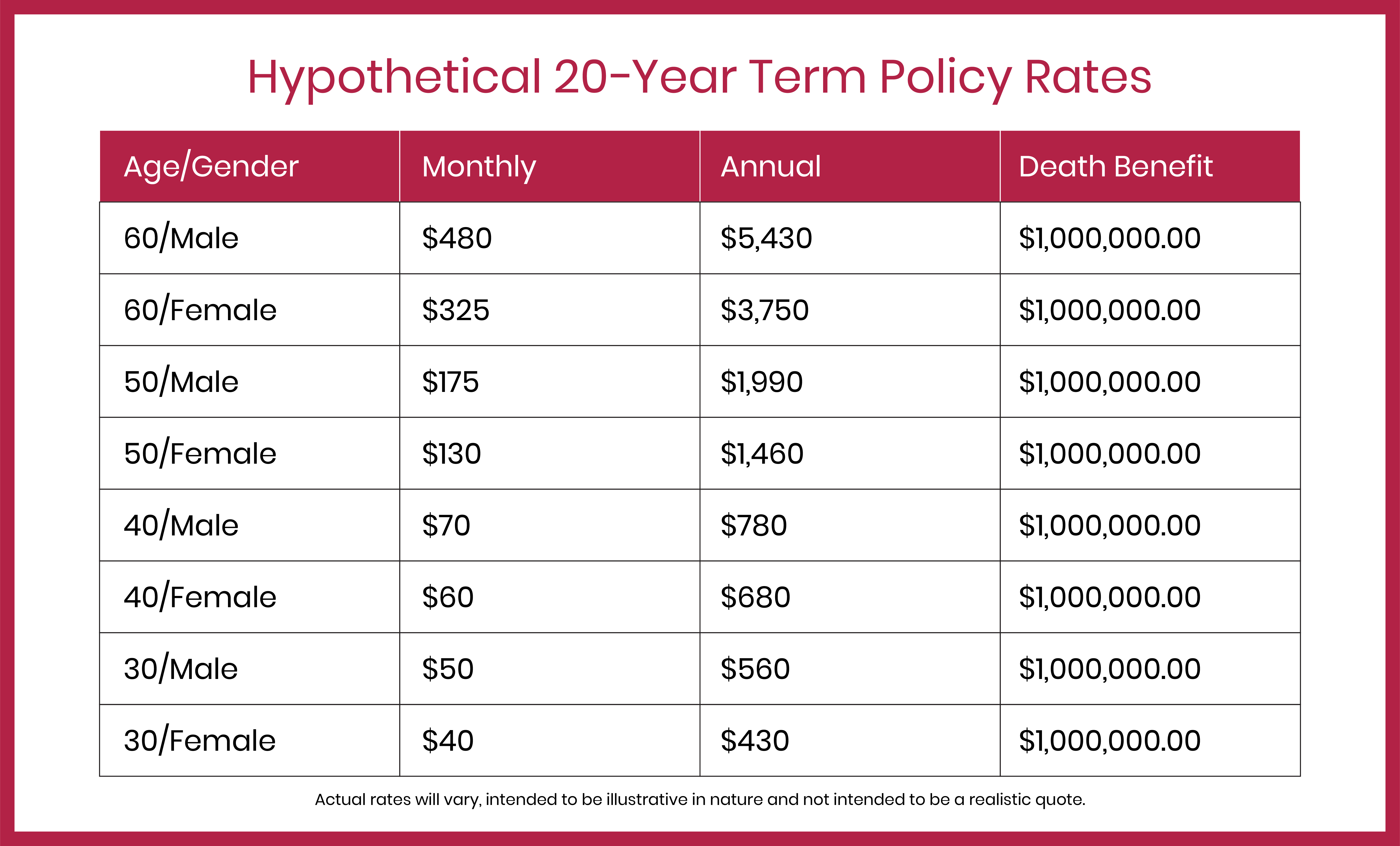

The table below shows hypothetical rates a 20-year policy with a $1,000,000 death benefit. The ages on the left are the age of the policyholder on the day the policy starts. For example, the last row reflects the policy premiums a woman aged 30 would pay each month or year to be covered until she turns 50 years old. The premium amounts stay fixed throughout the term.

In a perfect world, the payments from term life insurance policies would perfectly match the lost income from the policyholder’s untimely death. Instead, a large one-time payment is made. This keeps things simple; however, the expectation is that the money will be invested in investments that will generate the missing income for your family. The payout is tax-free, so there’s no uncertainty around how much money the family gets. The only uncertainty is making sure the proceeds are invested appropriately to produce the needed income.

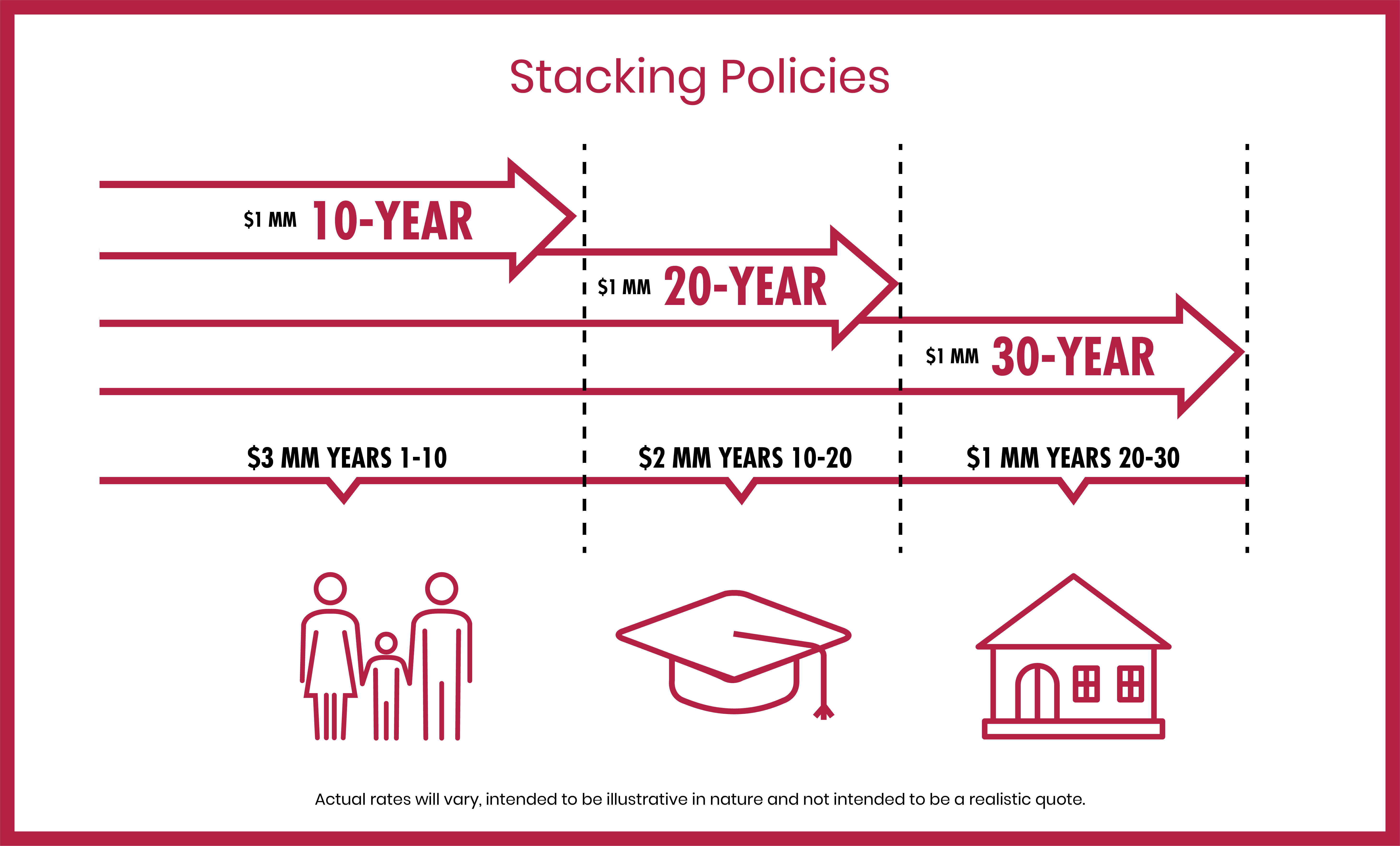

Stacking Policies

Multiple term policies can be combined or “stacked” to create a total payout that matches the changing needs of a family over time. For example, you could combine 30-year, 20-year, and 10-year policies with $1 million payouts each to have $3 million in coverage for the first ten years when the children are young, then $2 million when they have move into young adulthood, and finally $1 million after the kids are grown and gone.