Survivor Universal Life

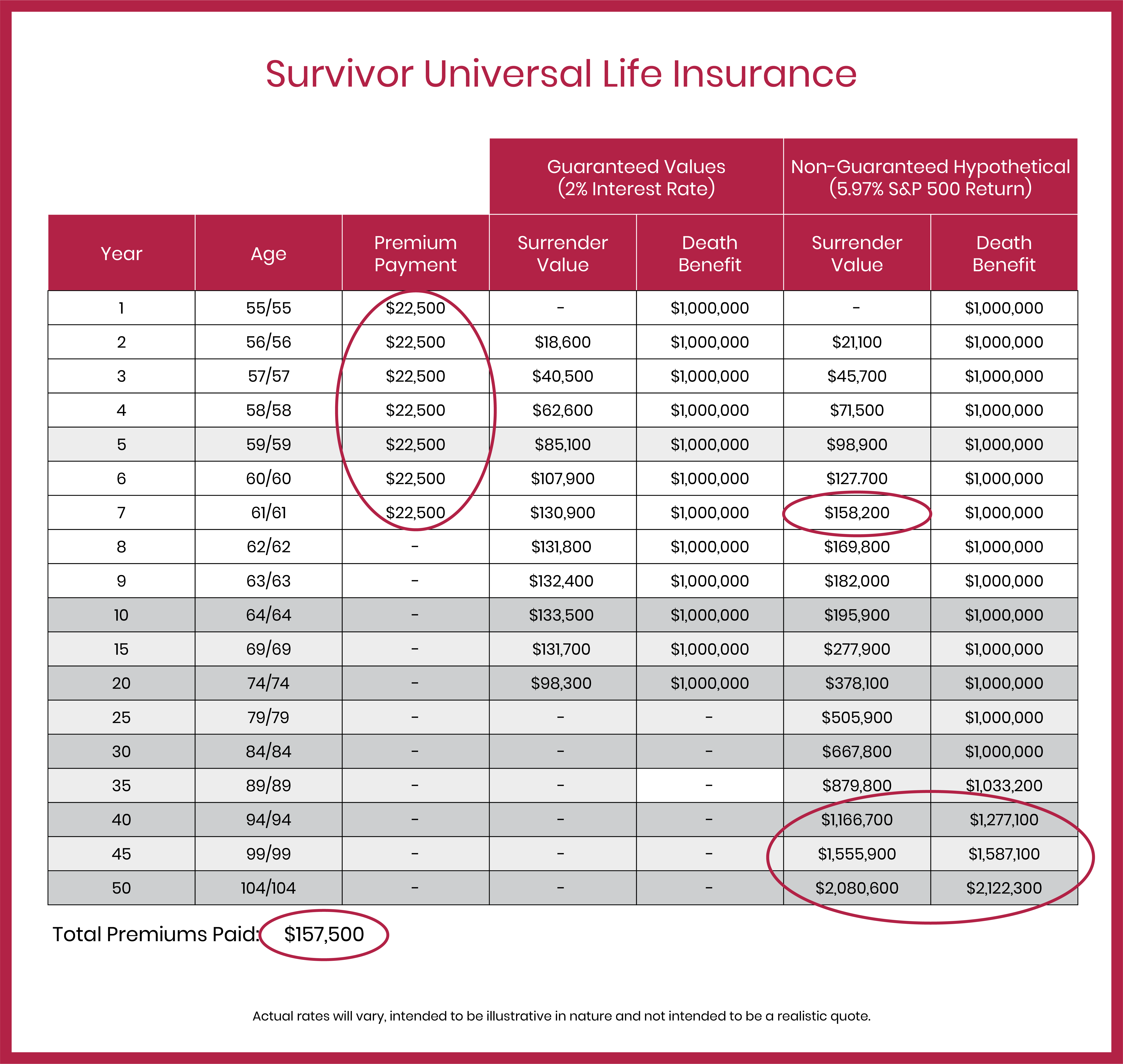

Survivor Universal Life (SUL) insurance is similar to regular universal life (UL) insurance but designed to take into effect after the passing of both members of a couple. By “survivor” the policy means the payout is triggered when the “survivor” passes. First one member passes, making the remaining member a “survivor,” who then passes away, triggering the death benefit. The illustration below shows how this works. Note that it is very similar to the UL illustration. The key differences from are the UL illustration are that the policy is now contingent upon the death of two people (making it less likely to be triggered very soon) and the absence of a “Death Benefit Guarantee” rider. Both of these serve to lower the premium payments.

As with our Universal Life illustration, here we use a “7-Pay” policy, meaning the out-of-pocket premiums are only paid for the first 7 years. Thereafter the premiums are effectively paid out of the accumulated cash balance. Once the cash balance is drawn down completely (in the base-case/guarantee scenario), the policy lapses and there is no more death benefit. In the “Non-Guaranteed Hypothetical” scenario, where we assume a 5.97% annual return on the S&P 500, the cash value grows fast enough to pay the insurance premiums and contribute additional value to keep growing the cash value balance. As this surpasses the death benefit, the death benefit itself begins to rise roughly in line with the cash value, thus increasing the amount that can be left to the next generation tax-free.